< VIEW FULL INFOGRAPHIC HERE >

PART I: The State of the OTT Market

Conviva, the leading provider of measurement and analytics services for 7 out of the top 10 US SVOD publishers (as noted by Parks & Associates), has a global data set comprised of viewer data from over 180 countries connected to the internet by over 1,200 internet service providers (ISP). Conviva collects a continuous video measurement census of 57%* of the United States internet population.

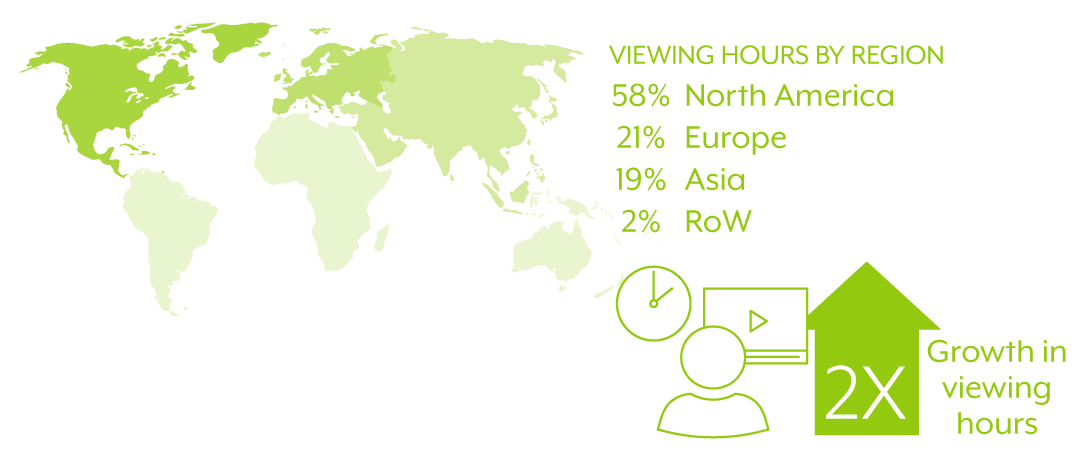

Viewing Time

Conviva has seen the viewing hour growth rate accelerate over the past several years as more consumers move their TV-watching from traditional linear pay TV services to a very wide variety of OTT services offered by both pure play OTT publishers and MVPDs as well as pay TV providers diversifying their service offerings. Conviva expects to see continued accelerated growth over the course of 2018 across both existing and new customers.

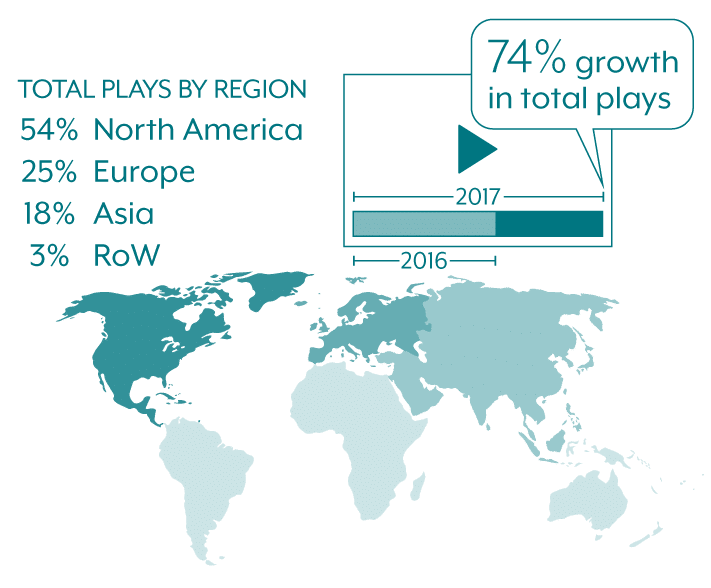

Plays

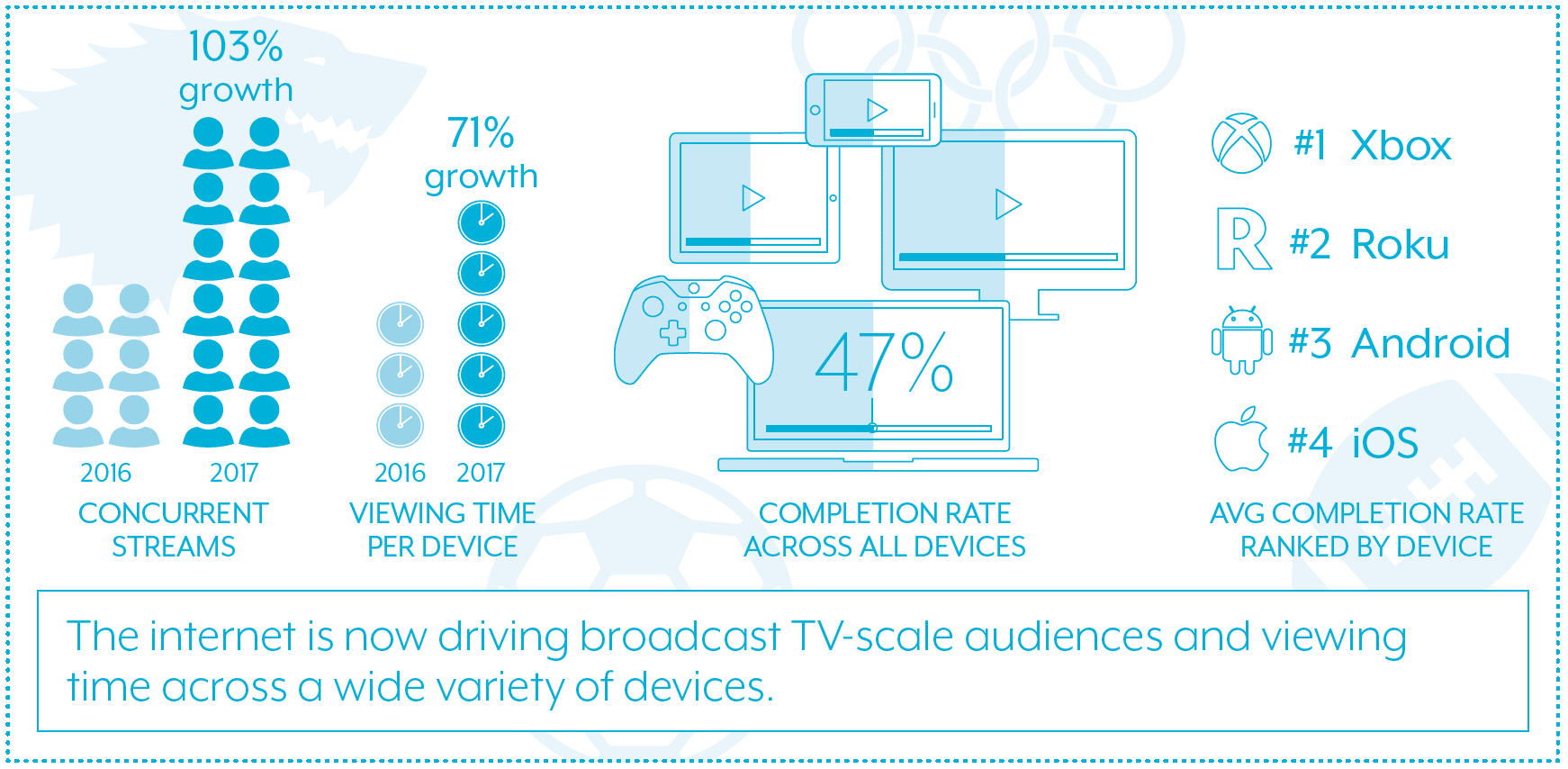

Concurrency

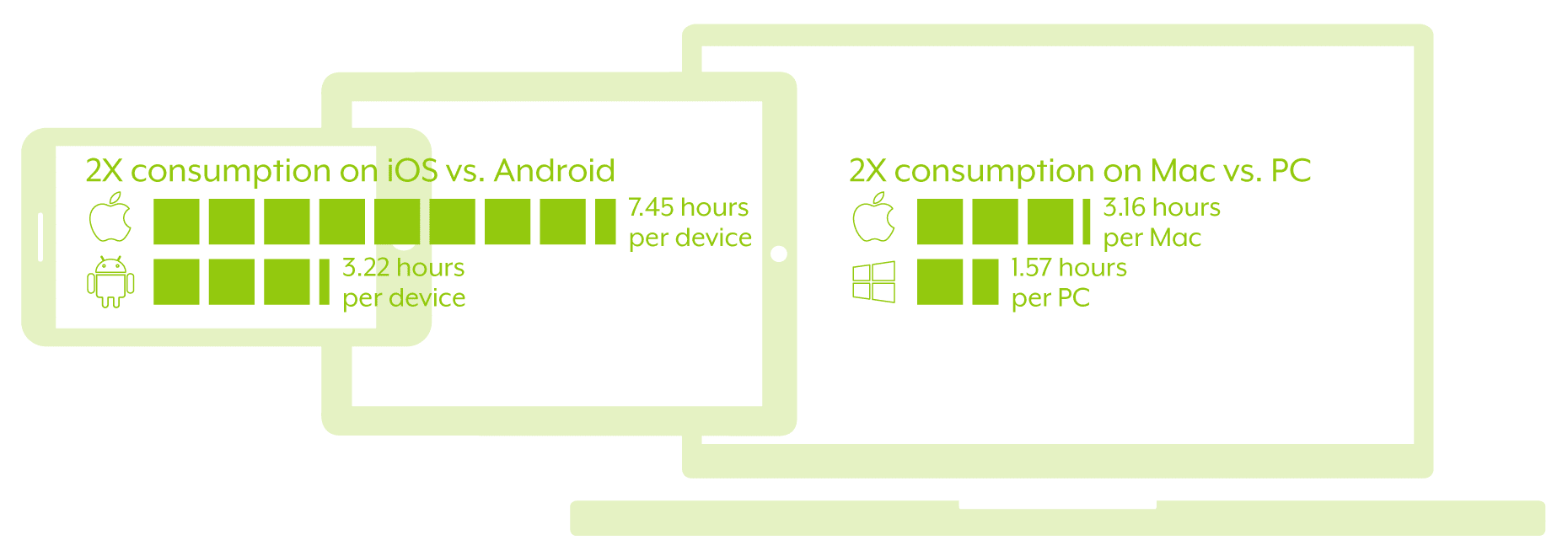

Year on year, Conviva has been seeing more of these spikes as well as a general lift in the baseline. What’s more, the average completion rate Conviva witnessed was 46.6% across all devices, along with a 71% growth in viewing time per device. By device type, the average completion rate over the course of the year was: Xbox at #1, Roku following at #2, Android coming in at #3, and iOS at #4. From this data, an assumptive conclusion can be drawn showing (assuming that the majority of Xbox and Roku viewing is not mobile, but rather in-home) that classic in-home TV viewing behavior is more conducive to completing episodes and/or live event viewing. Whereas streaming on a mobile device may more likely be interrupted, or simply involve a more impatient viewer.

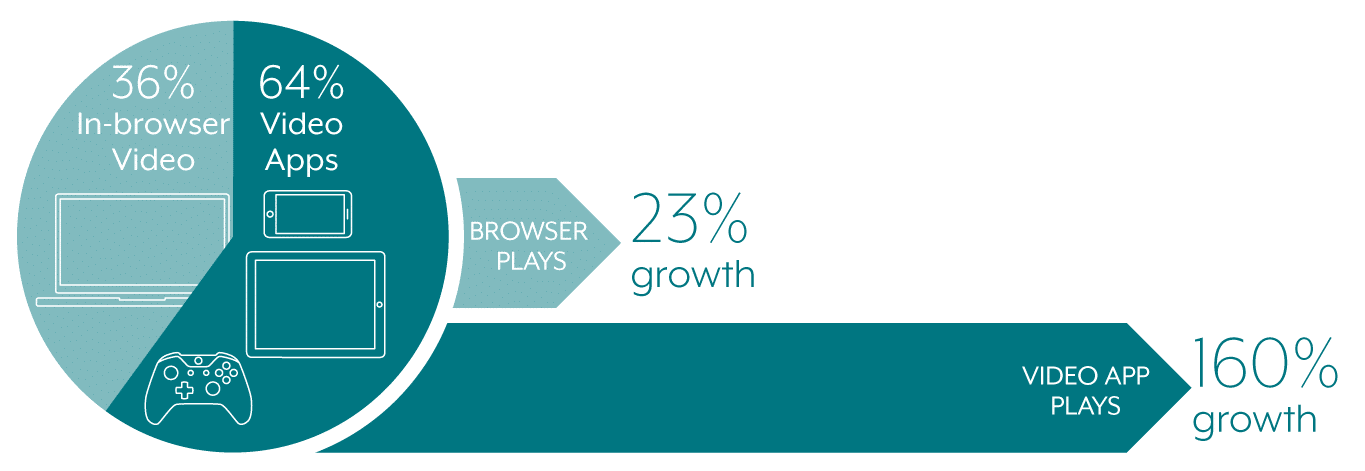

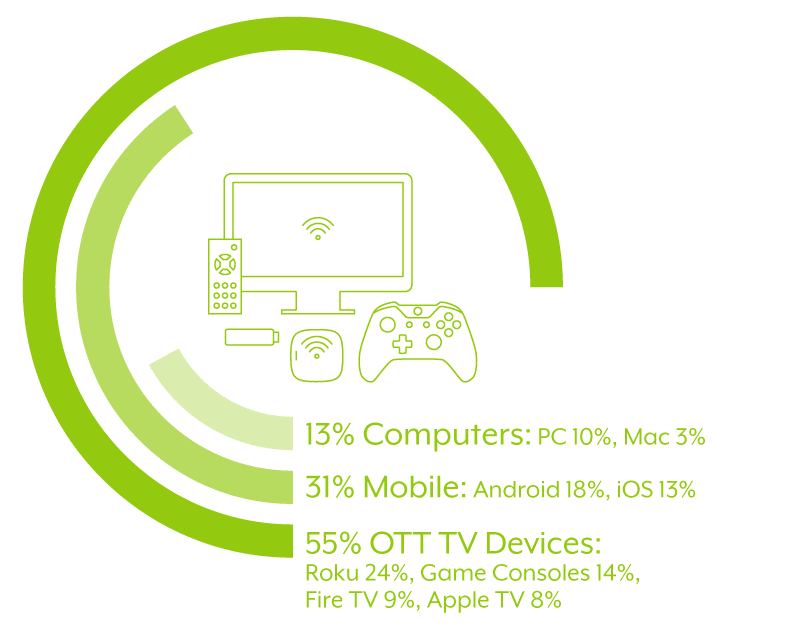

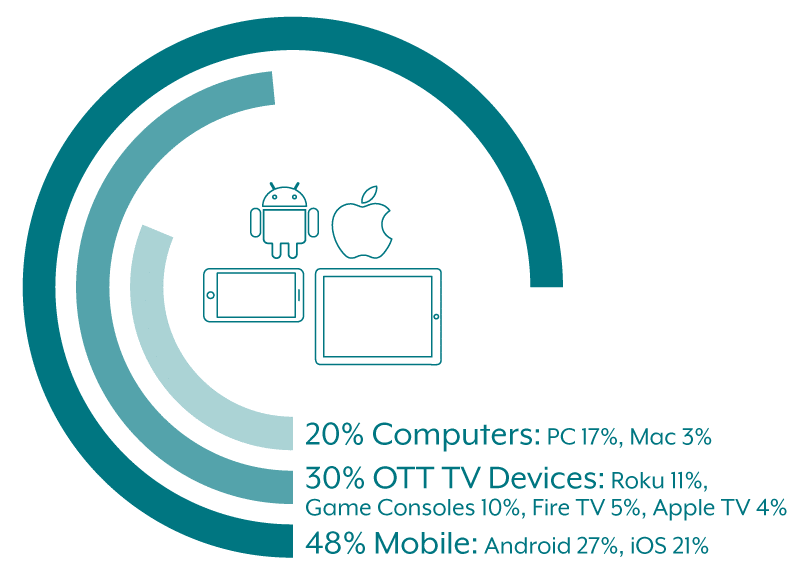

Devices

PART II: State of OTT Streaming Video Quality of Experience (QoE)

The four global QoE metrics that Conviva’s customers monitor closely and set KPIs against to drive the most increased engagement and subscriber retention include:

1. Rebuffering Ratio

2. Video Start Time (VST)

3. Bitrate

4. Video Start Failures or Exits (VSF)

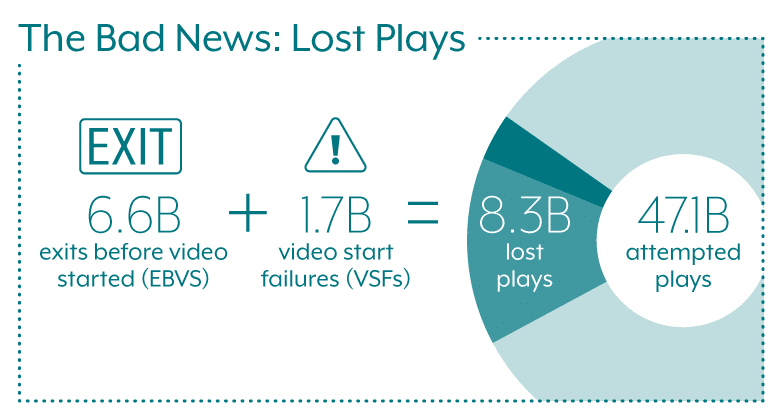

Video Start Time

Conviva saw a total of 47.1B attempted plays in 2017, 38.8B of which successfully started watching the video, and the rest (17.7%) resulted in a video start failure (VSF) or an exit before the video started (EBVS). This equates to 8.3B times a consumer attempted to watch a video and was unsuccessful! Over the course of the year, 3.6% of the attempts were VSFs whereas 14.1% were EBVSs. These 8.3B lost attempts could have driven 2.6B more viewing hours for the OTT market in 2017!

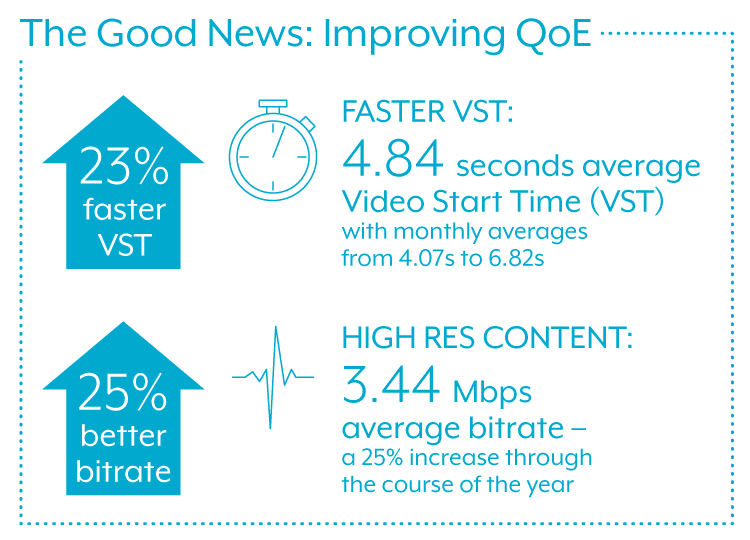

Through the course of the year, it took on average 4.84 seconds for a video to start (this is a 23% improvement from last year), with a high of 6.82 seconds and a low of 4.07 seconds according to monthly averages. Video start times can really spike when there are issues with a CDN provider that is experiencing very high loads or operational issues. In December 2017, the average VST was 4.37s in apps and 5.96s in browsers – this difference remained the same for most of the year.

Overall, the average bitrate Conviva saw was 3.44Mbps – this represented a 25% increase over the course of the year. As bitrate increases pixilation decreases and high definition screens are fully utilized.

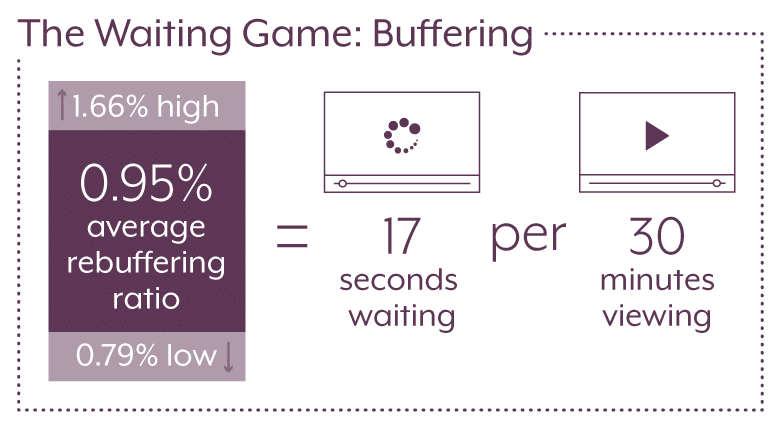

Buffering

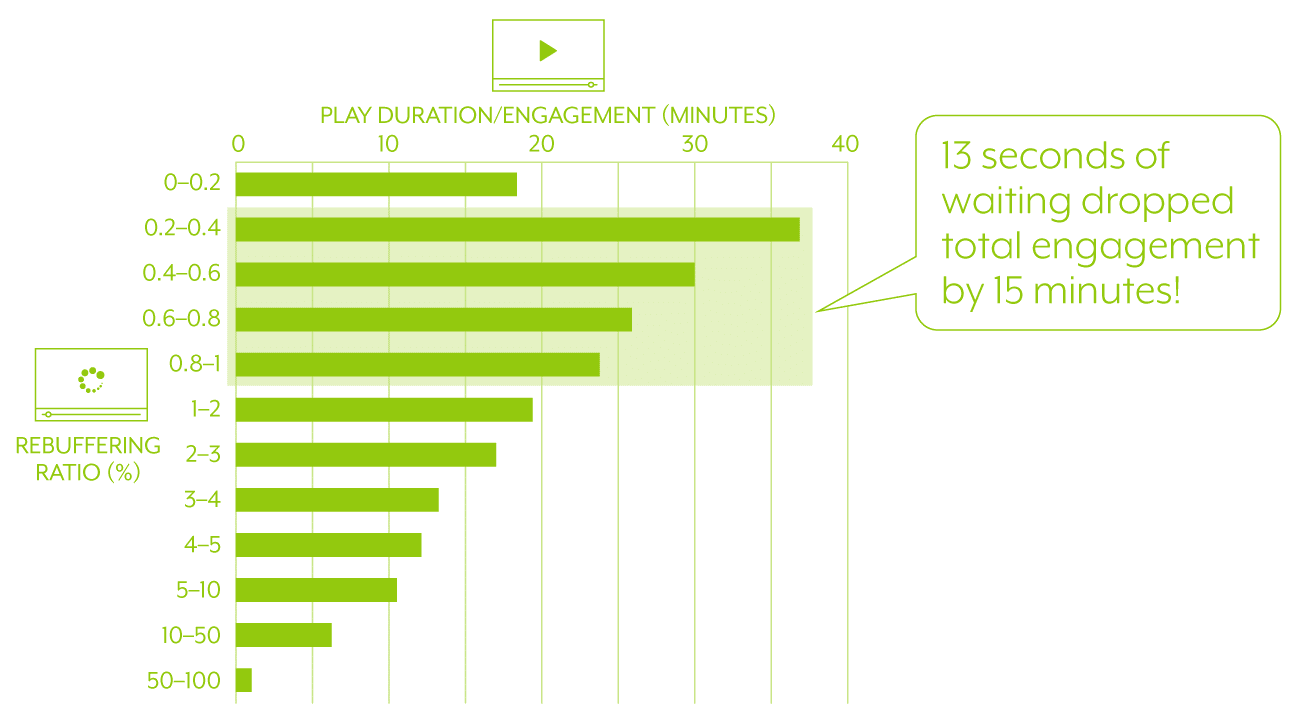

Engagement

Overall, this data means that real-time monitoring of QoE metrics can be used as predicative indicators of increased or decreased engagement, viewer satisfaction, and OTT revenue.

The OTT market continues to see explosive growth not only in the number of viewers, but the amount of time spent viewing as well. While the data in this report is based solely on Conviva’s customers, the Conviva customer base covers close to 60% of the internet population and measures 7 out of the top 10 SVOD providers in the US, as well as many other OTT providers globally. As far as Conviva is aware, this is the largest, multi-publisher, global OTT streaming video continuous measurement census available.

*In 2017, Conviva saw 1.04B unique streaming apps on devices just in the United States. Conviva data shows on average there are 2.2 video streaming apps per device; in the U.S. there are 2.9 devices per person. Of the entire US internet population (287M), Conviva sees 163M unique internet viewers.

It should be noted that the following data in this report is international, and actual customer names are not disclosed. This is an anonymized summary of all Conviva customer data providing a unique, independent view of the state of the OTT market.